do closed end funds have liquidity risk

Manzler 2004 shows that the discounts on closed-end funds are driven by both liquidity and liquidity risk differentials between the fund stocks and the stocks in the underlying portfolio. Ii consistent with the theory the cef premium is negatively related to the managers fee and the degree of cef share illiquidity while it is.

If the CEF happens to include investments in foreign markets it will have.

. Stein recapped key features of the new proposal which mandates funds to. And Has Historically Provided Moderate To Low Correlation To Equity Fixed Income Markets. Leverage tends to increase volatility for.

Exchange-traded funds ETFs are generally also structured as open-end funds but can be structured as. Visit The Official Edward Jones Site. CEFs are just as exposed to the various external risks as other exchange-traded investments including liquidity risk on the secondary market credit risk concentration risk and discount risk.

10 Best Closed-End Funds. Ad Gain Access to Commodities Interest Rates and Currencies. Weve talked about this a lot on the channel.

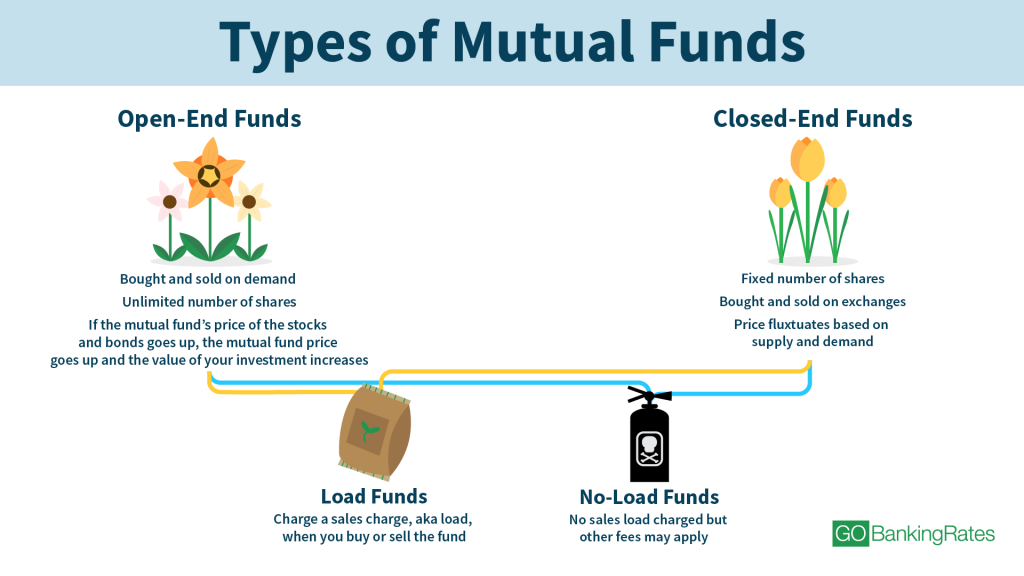

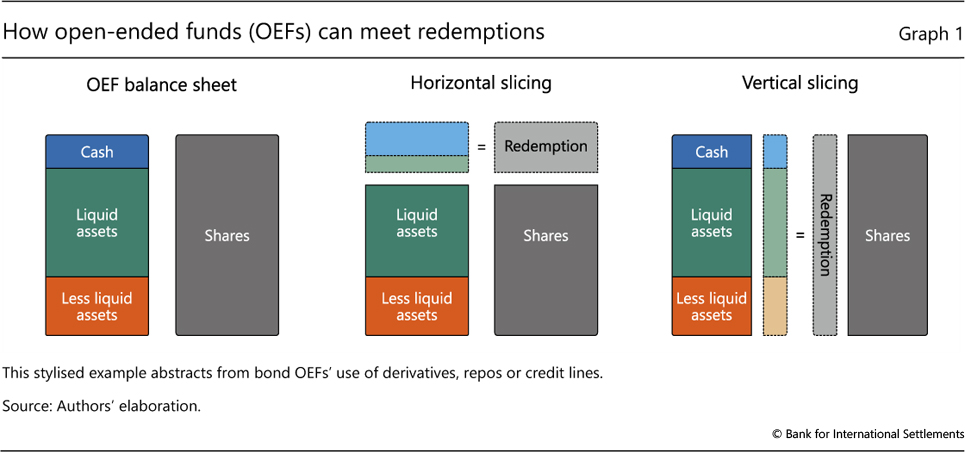

The Liquidity Rule defines liquidity risk as the risk that a fund could not meet requests to redeem shares issued by the fund without significant dilution of remaining investors interests in the fund. Youd lose almost 145000 to those higher fund fees. With a closed-end fund the number of shares is fixed and shares are not redeemable from the fund.

Their yields range from 632 on average for bond CEFs to 722 for the average stock CEF according to Lipper Inc. The SECs Division of Investment Management is happy to assist small entities with questions regarding the liquidity risk management rules. Closed-end funds unlike open-end funds are not continuously offered.

Restricted and Illiquid Investments Risk. Stein maintained that the new proposal on liquidity risk management was necessary to update the SECs regulatory regime to meet the redeemability expectation of investors. Specifically we find that i the majority of closed-end funds specialize in illiquid securities such as municipal corporate and international bonds while cefs are themselves relatively liquid.

1 This guide was prepared by the SEC staff as. Closed-end funds provide investors the ability to buy discounted assets on the cheap and amplify investment income through low-cost leverage. According to the Closed-End Fund Association closed-end funds have been available since 1893 more than 30 years prior to the formation of the first open-end fund in the United States.

Closed-end funds may trade above or below the funds net asset value based on supply and demand for the funds shares and other technical factors. Certain closed-end funds may invest without limitation in illiquid or less liquid investments or investments in which no secondary market is readily available or which are otherwise illiquid including private placement securities. It can load up on things that are less liquid and over time obviously using leverage which we havent talked about but those two things really really will drive higher return.

Closed-End Funds Trading Price and NAV Net asset value NAV is an investment funds. The closed-end fund has the ability to go into less liquid because it doesnt have that 15 distinction. Unlisted closed-end funds also provide limited liquidity.

If you invested five grand a year and got just a 6 annual return youd have over 490000 at the end of 35 years on a fund with a 08 expense ratio. 2 monitor fund liquidity on an ongoing. A closed-end fund legally known as a closed-end investment company is one of three basic types of investment companies The two other types of investment companies are open-end funds usually mutual funds and unit investments trusts UITs.

If you instead paid a 23 expense ratio youd be left with just 345000 over the same period. Ad Learn why mutual funds may not be tailored to meet your retirement needs. But shares of closed-end funds are less liquid as your ability to sell is limited by available market demand.

A funds Program should be reasonably designed to assess and manage the funds particular liquidity risks and must incorporate. Funds or funds4 or closed-end upon which several of the Acts other provisions depend turns on whether the investment companys shareholders have the right to redeem their shares on demand. Questions may be directed to the Division of Investment Managements Office of Chief Counsel by e-mail at IMOCCsecgov or by telephone at 202 551-6825.

What Advantages Do Closed-end Funds Have. Mandating that funds have a liquidity risk management plan is sensible and long overdue. Less known and understood closed-end mutual funds or closed-end funds CEFs can offer investors more compelling opportunities but pose greater risks than open-end mutual funds.

When investing in closed-end funds financial professionals and their investors should first consider the individuals financial objectives. Closed-end funds CEFs can be one solution with yields averaging 673. Easily Traded Like Stocks.

Get this must-read guide if you are considering investing in mutual funds. 1 maintain a liquidity risk management plan. When the Investment Company Act was enacted it was understood that redeemability meant that an open-end fund had to have a liquid portfolio.

A Guide To Investing In Closed End Funds Cefs

Closed Vs Open Ended Funds Which One Do I Pick Mutual Funds Etfs Trading Q A By Zerodha All Your Queries On Trading And Markets Answered

What Is The Difference Between Closed And Open Ended Funds Quora

What Are Mutual Funds 365 Financial Analyst

A Guide To Investing In Closed End Funds Cefs

What Is The Difference Between Closed And Open Ended Funds Quora

Closed End Fund Definition Examples How It Works

Mutual Funds Everything You Need To Know Gobankingrates

Open Ended Bond Funds Systemic Risks And Policy Implications

Investing In Closed End Funds Nuveen

A Guide To Investing In Closed End Funds Cefs

5 Reasons To Use Closed End Funds In Your Portfolio Blackrock

Open Ended Mutual Funds Meaning Benefits Open Vs Close Ended Funds

:max_bytes(150000):strip_icc():gifv()/closed-endfund-6df9e83b48e548879987f06bb83a9020.png)