cap and trade versus carbon tax

With a tax you get certainty about prices but uncertainty about emission reductions. Basis Cap and Trade Carbon Tax.

Cap And Trade Basics Center For Climate And Energy Solutionscenter For Climate And Energy Solutions

A carbon tax imposes.

. The first is a carbon tax and the. Carbon Tax vs Cap-and-Trade. Governments enforce Cap and trade programs.

With a cap you get the inverse. The David Suzuki Foundation believes this price should be applied broadly in the Canadian economy but that it can be done either through a carbon tax a cap-and-trade system or a. Experts often debate the pros and cons of a carbon tax versus a cap-and-trade system in the United States and they will do so again at an event in Washington DC tomorrowA carbon tax directly establishes a price on greenhouse gas emissionsso companies are charged a dollar amount for every ton of emissions they.

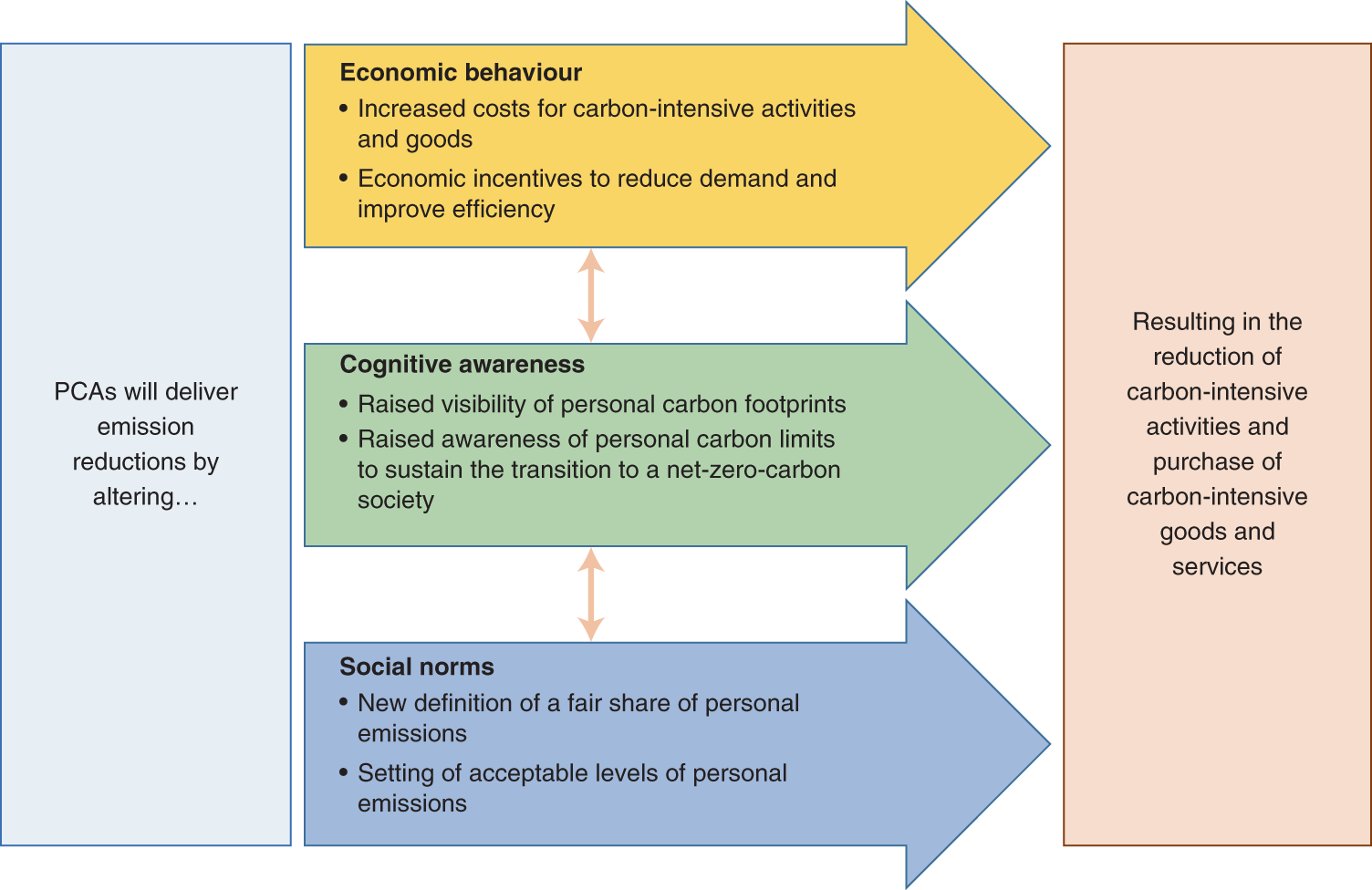

This can be implemented either through a carbon tax known as a price instrument or a cap-and-trade scheme a so-called quantity instrument. We examine the relative attractions of a carbon tax a pure cap-and-trade system and a hybrid option a cap-and-trade system with a price ceiling andor price. With a tax you get certainty about prices but uncertainty about emission reductions.

Economists have come up with to address climate change. Therefore the simulation policies include the. Jim DiPeso Jim DiPeso.

Cap Trade Carbon Markets If a governing body wishes to reduce emissions they generally have two levers to pull. Carbon taxes put an initial financial burden on entities that. Republicans for Environmental Protection.

Carbon taxes vs. While Carbon taxes are way easier to implement and are less open to political challenges the Cap and Trade systems are more likely to provide appropriate pricing. Theory and practice Robert N.

A carbon tax while not easy to implement across borders would be significantly simpler than a global cap-and-trade system. You can tweak a tax to shift the balance. Carbon taxes and cap-and-trade are the two big ideas US.

Search for more papers by this author. At the same time the economys performance affects the. This policy is compared with cap1 in terms of the efficiency of carbon reduction and energy conservation as well as social costs.

The impact of the carbon tax and cap-and-trade on a countrys economy is significant. Carbon tax versus cap-and-trade. Cap and Trade vs Carbon Tax.

Stavins1 Harvard Kennedy School This paper compares the two major approaches to carbon pricing carbon. The difference between both the regulations are as follows. -Like the Cap-and-Trade system a Carbon Tax can be structured such that 100 percent of the money is returned directly to the people who are taxed-A Carbon Tax.

You can tweak a tax to shift the balance. If the European Unions Emission Trading Scheme. Carbon Tax vs.

With a cap you get the inverse.

Cap And Trade Vs Carbon Tax Ppt Download

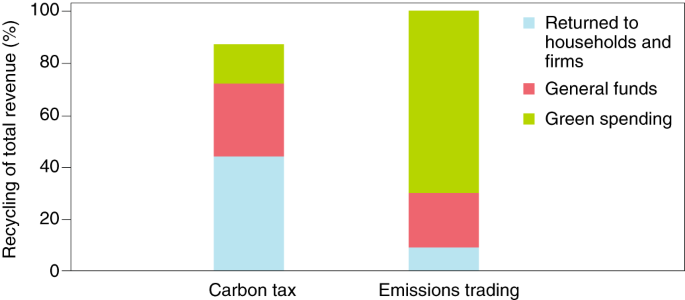

Making Carbon Pricing Work For Citizens Nature Climate Change

Difference Between Carbon Tax And Cap And Trade Youtube

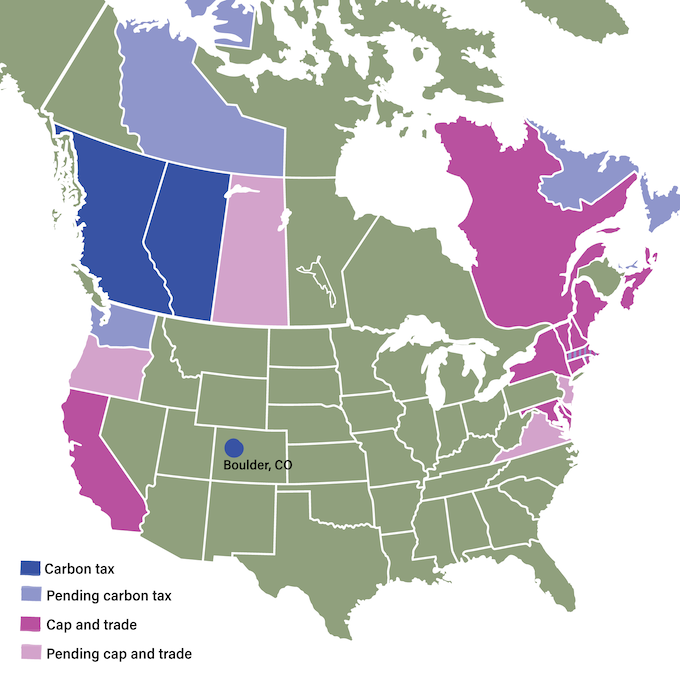

Carbon Taxes And Cap And Trade State Policy Options Muninet Guide

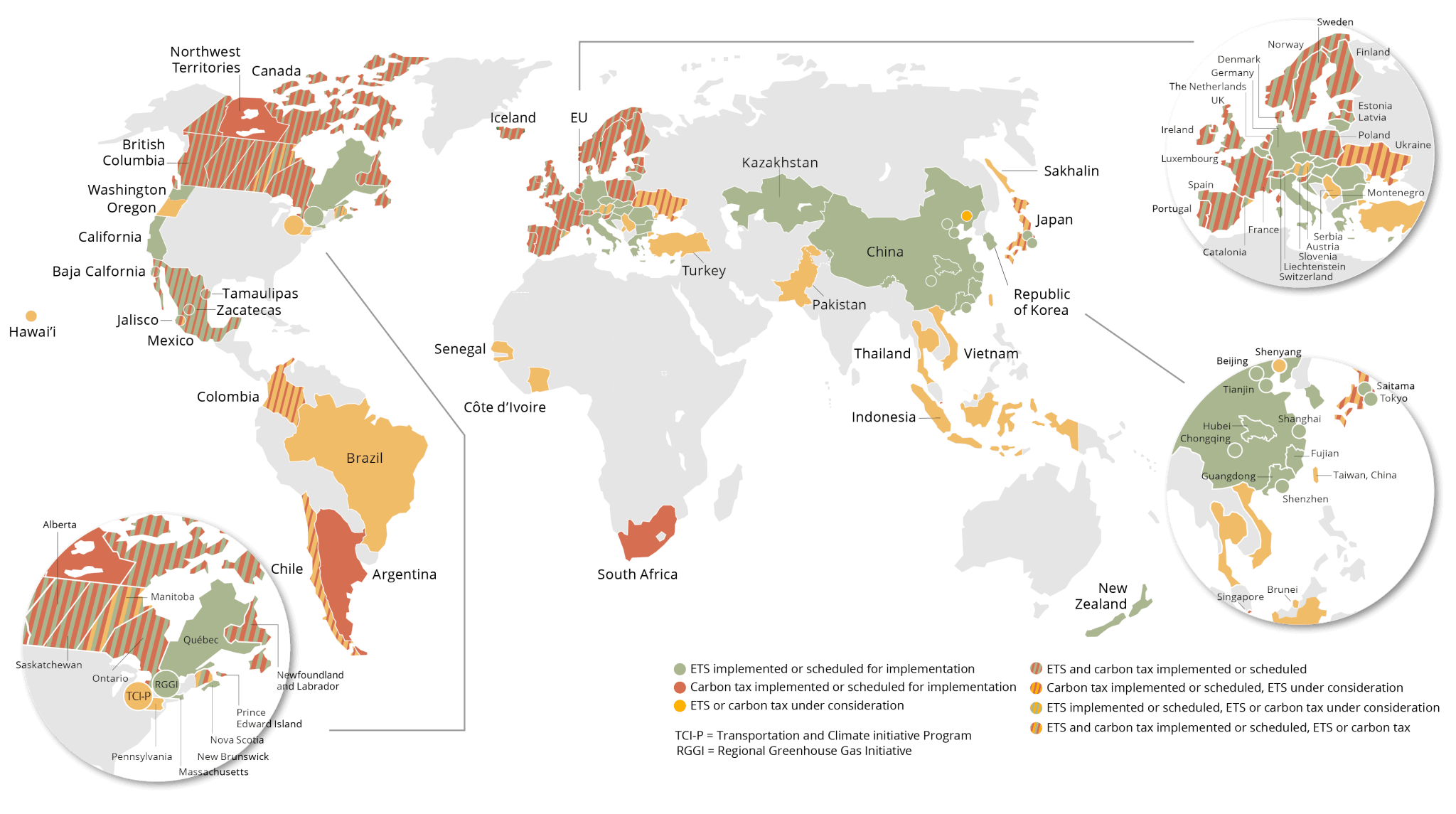

More States And Provinces Adopt Carbon Pricing To Cut Emissions Aceee

Where Carbon Is Taxed Overview

Efficient Pricing Of Carbon In The Eu And Its Effect On Consumers Journalquest

Carbon Tax And Cap And Trade Youtube

Cap And Trade Vs Carbon Tax Earth Org

Carbon Policy Bc Carbon Tax Link To The World

Kathleen Wynne S Attack On The Ontario Pc Carbon Tax Plan Misleads Voters Macleans Ca

Difference Between Carbon Tax And Cap And Trade Difference Between

Personal Carbon Allowances Revisited Nature Sustainability

Carbon Taxes Vs Cap And Trade The Economist Commodity Research Group

Pricing Carbon A Carbon Tax Or Cap And Trade

Cap And Trade Vs Carbon Tax Youtube

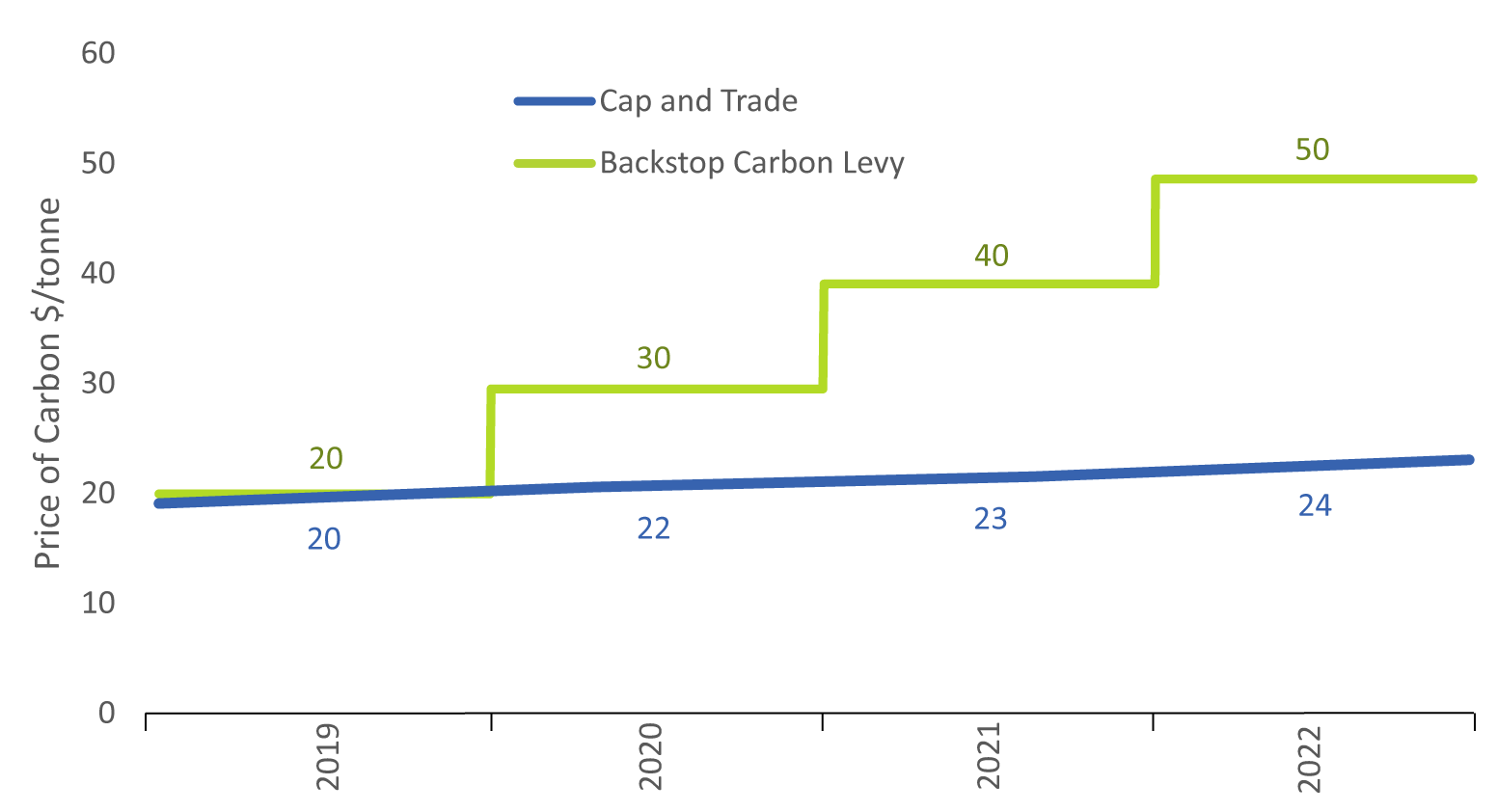

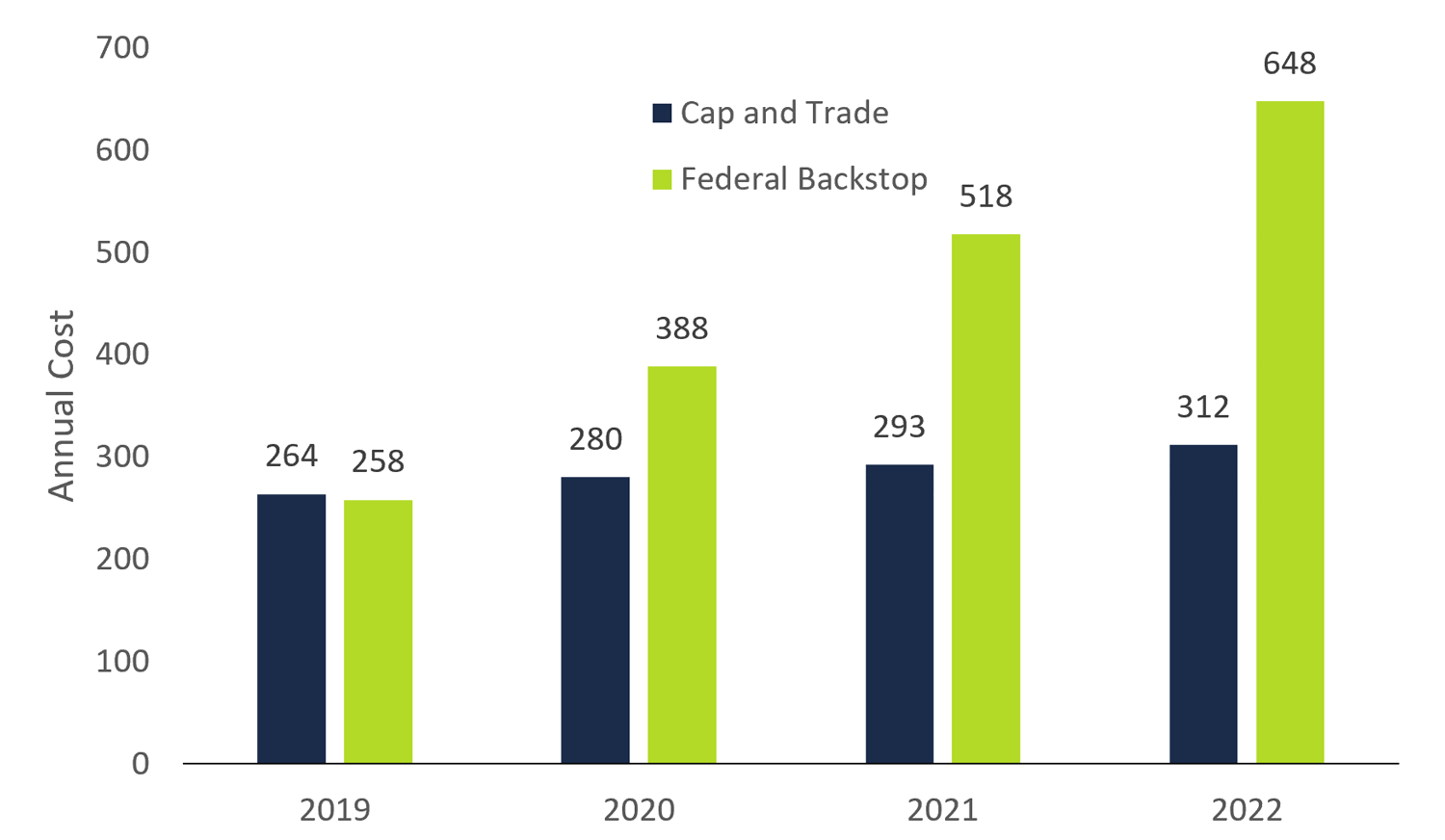

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Hooray For Carbon Taxes Mother Jones

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program