what is a tax lot number

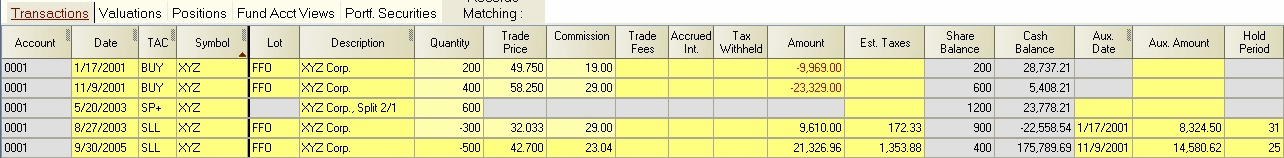

Using the number in the GainLoss Weighted column we have a relief order that differs from the Maximize LossesMinimize Gains method. Find a propertys lot number by visiting the website for the county in which the property exists and locating the property search tool which may appear under a section for an.

If you own the property outright you can also type your name.

. In our example above we sold 20 shares of Company XYZ for 10 per share. A method of computing the cost basis of an asset that is sold in a taxable transaction. Visit your local tax assessors website and search for the property by its address or in some cases the owners name.

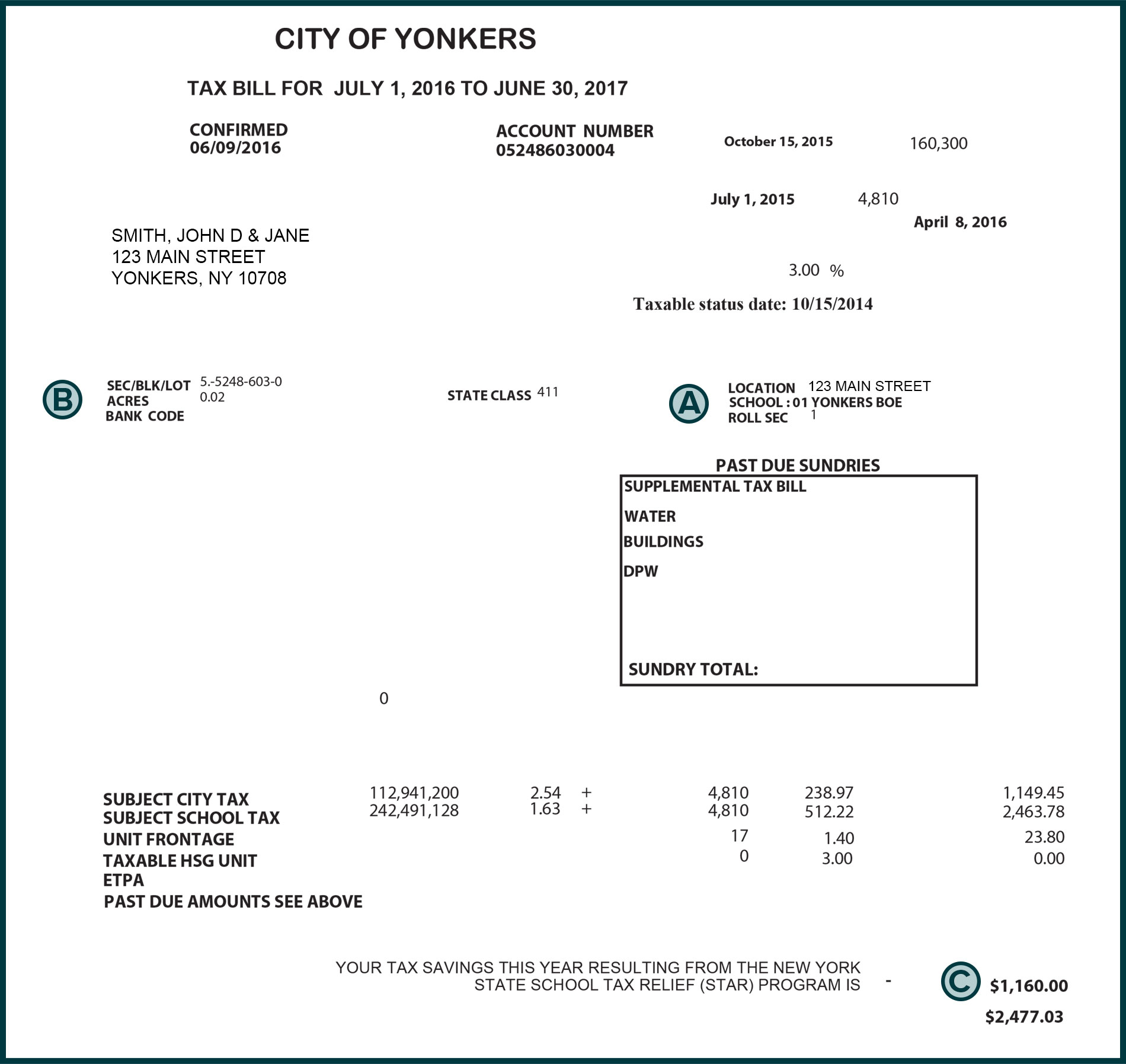

Each acquisition of a security on a different date or for a different price constitutes a new tax. It is shown on your tax bill and used by the. Assessor information by county.

By comparing the sale price to the cost basis you and the IRS make an accurate determination on the profits. Click Search Select the appropriately labeled. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares Your choice of tax lot ID method can have a significant.

You dont have to be the property owner to access this. Finally the tax lot includes the sale price of the securities in the lot. Type the Street Number and Street Name into the boxes on screen.

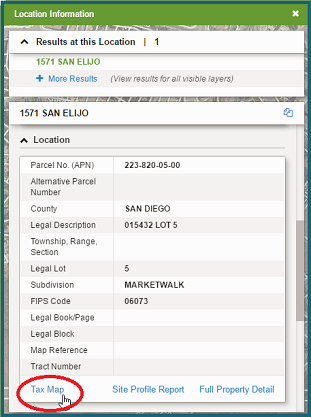

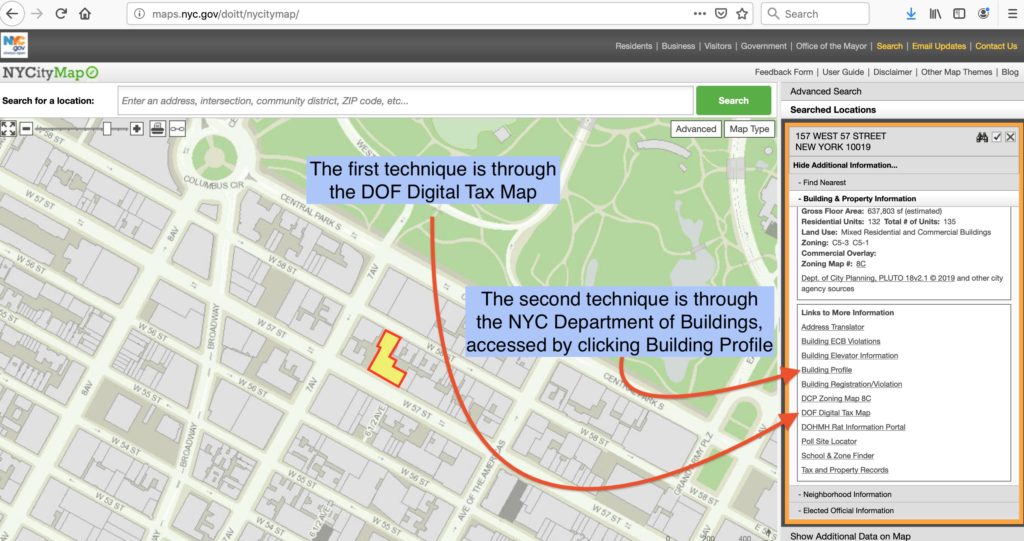

Lot Relief Method. The value of the tax lot does not change. Through the Tax Maps Application you can access PDF copies of the.

Parcel Number The Parcel Number or Local Number is the same as the Tax ID Number assigned by the Assessors Office. There are five major lot relief methods that can be used for this purpose. A tax lot is a record of the details of an acquisition of a security.

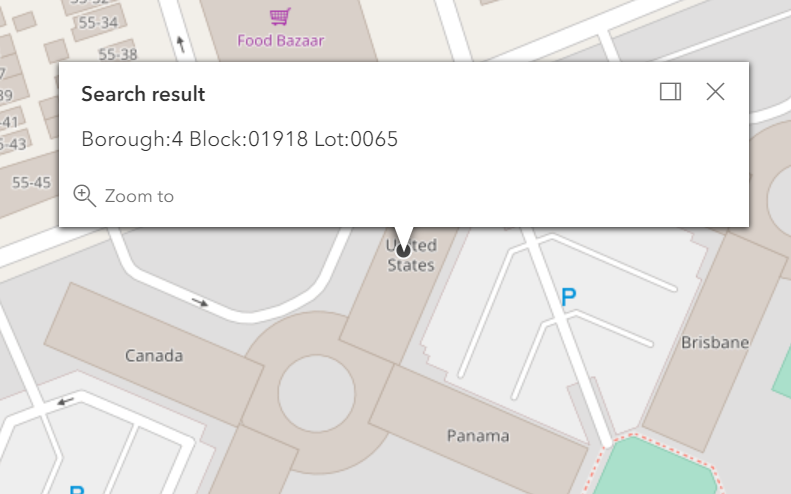

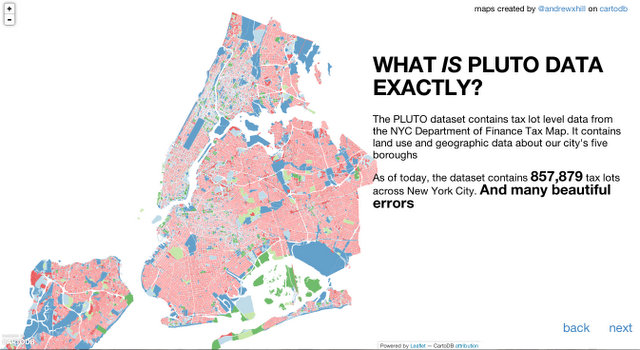

SBL number means Section-Block-Lot number on the County of Saratogas Real Property Tax maps. Tax maps show lot lines lot and block numbers street names lot dimensions subdivision names and other information. The official tax maps for the City of New York are maintained by the Tax Map Office.

Tax maps show the lot lines the block and lot numbers the street names lot dimensions and. SBL number means the Section-Block-Lot tax map number. Each acquisition of a security on a different date or for a different price constitutes a new tax lot.

A tax lot is a record of the details of an acquisition of a security. A tax lot is a record of a transaction and its tax implications including the purchase date and number of shares Your choice of tax lot ID method can have a significant. Deferral programs information for mortgage and title companies.

An index map is prepared showing the area covered by the tax map in a city town or village. Every parcel on a tax map is assigned a parcel number. Tax lots reflect cost basis.

Tax lot accounting is important because it helps investors minimize their capital gains taxes. Board of Property Tax Appeals contacts. What Is A Tax Lot.

A lot number is an identification number assigned to a certain quantity or group of products from a single manufacturer. Every parcel on a tax map is assigned a parcel number and a coordinate locator number.

Receiver Of Taxes Mamakating Ny

Tax Finance Dept Sparta Township New Jersey

Bol Demo Unrealized Expanded Tax Lots

Pluto Data Maps Beauty By Number Crunching

Tax Commission Expense 2015 Form Fill Out Sign Online Dochub

Tax Maps Landvision Documentation

Seabird Apartments Map 28s 15w 36 Tax Lot 1420 Conditional Use Permit City Of Bandon Oregon

Theadvance 20220907 B 09 07 2022 Vid 11 W Or9 Art 1 Xml The Advance News

How To Find Information On Any Property In Bend Hack Bend

Nj Tax Maps Property Tax Records Download Property Reports

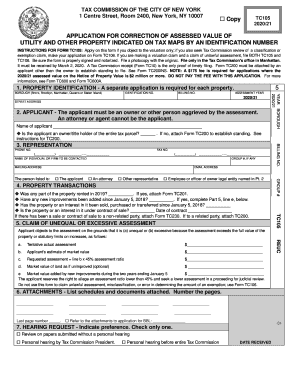

Utility And Other Property Indicated On Tax Maps By An Identification Number Fill Out And Sign Printable Pdf Template Signnow

Suffolk County Ny Tax Maps Are On Geodata Direct

How To Find The Pre Condo Lot Number For A Condo Building

How Do I Look Up The Map And Lot Number For My Property Address Eliot Me